Shopify tax calculation

As a Shopify business owner we help you automatically handle most tax calculations. Important Note on Calculator.

How To Set Up Automatic Tax Rates On Shopify

050 Rohnert Park City.

. The Sales Tax charged should have been. After youve determined where you need to charge tax in the United States you can set your Shopify store to automatically manage the tax rates used to calculate sales on taxes and set. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

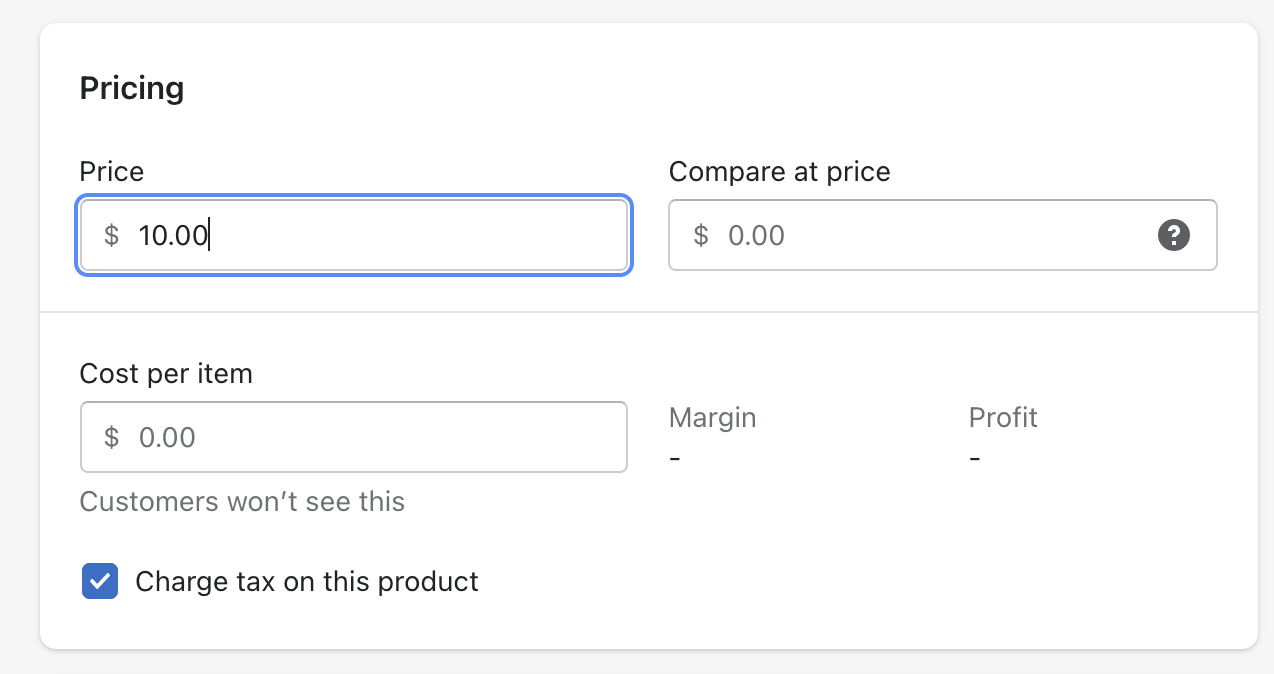

If you want to apply a specific tax rate to all your sales transactions you can use Shopifys Tax calculation tool. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage.

Keep more profit while reducing risk and stress. Zonos Duty and Tax. Keep more profit while reducing risk and stress.

Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. HS codes are recommended but not required to get started.

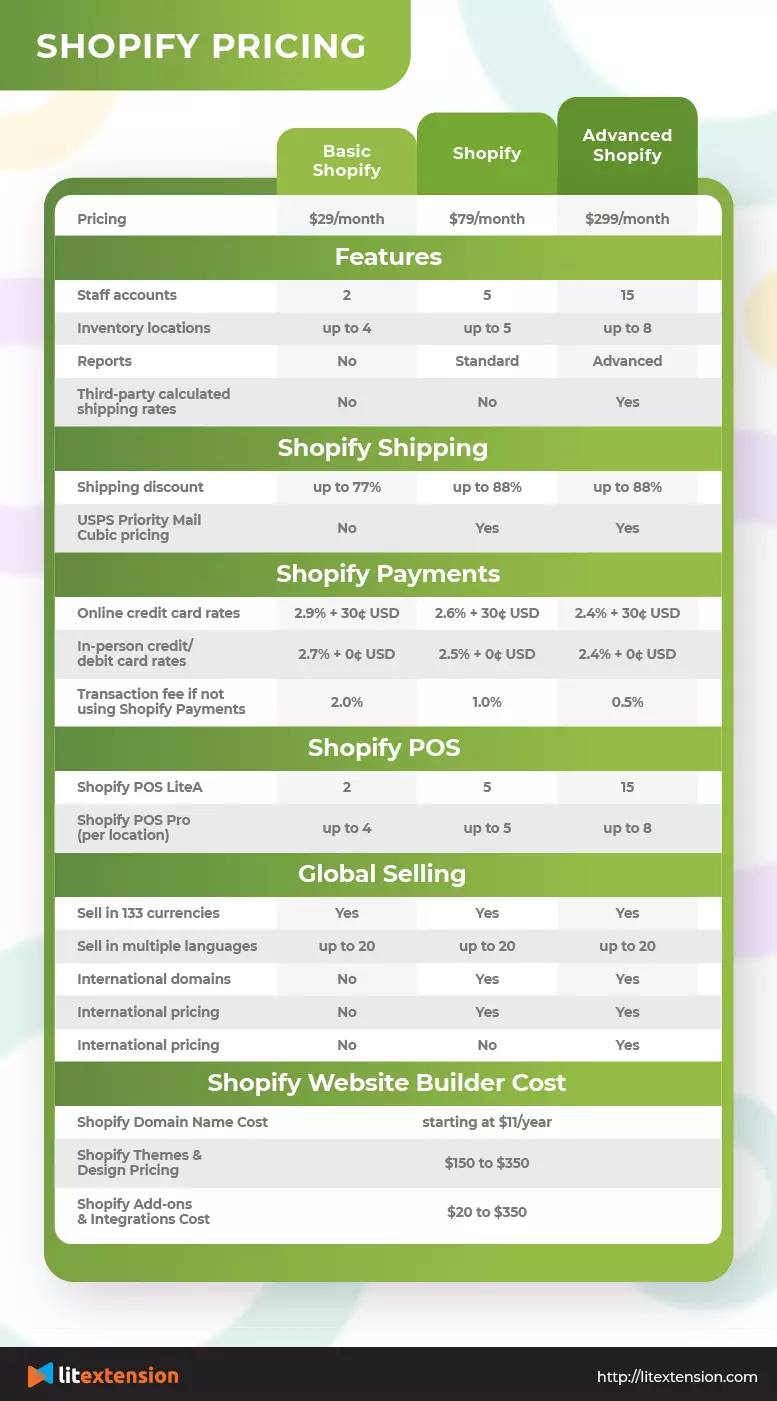

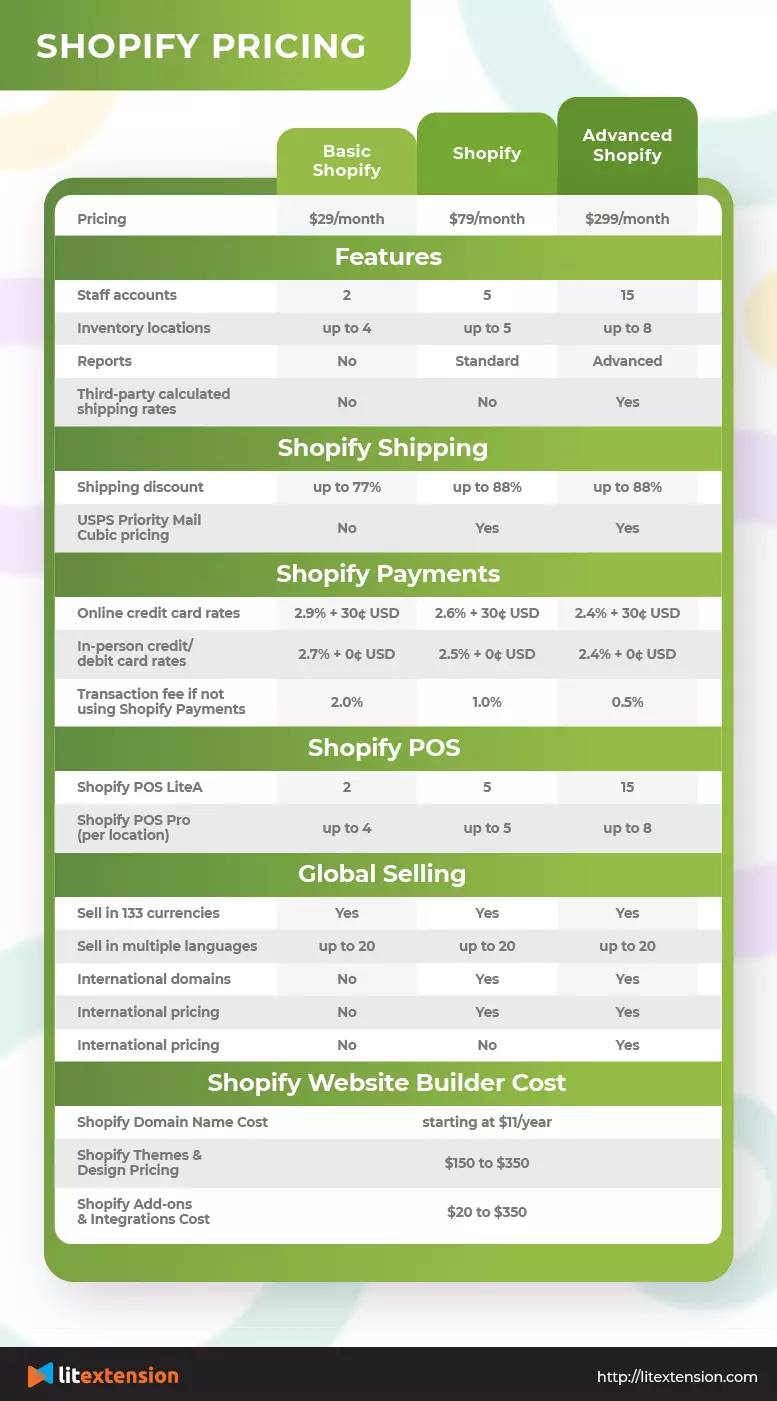

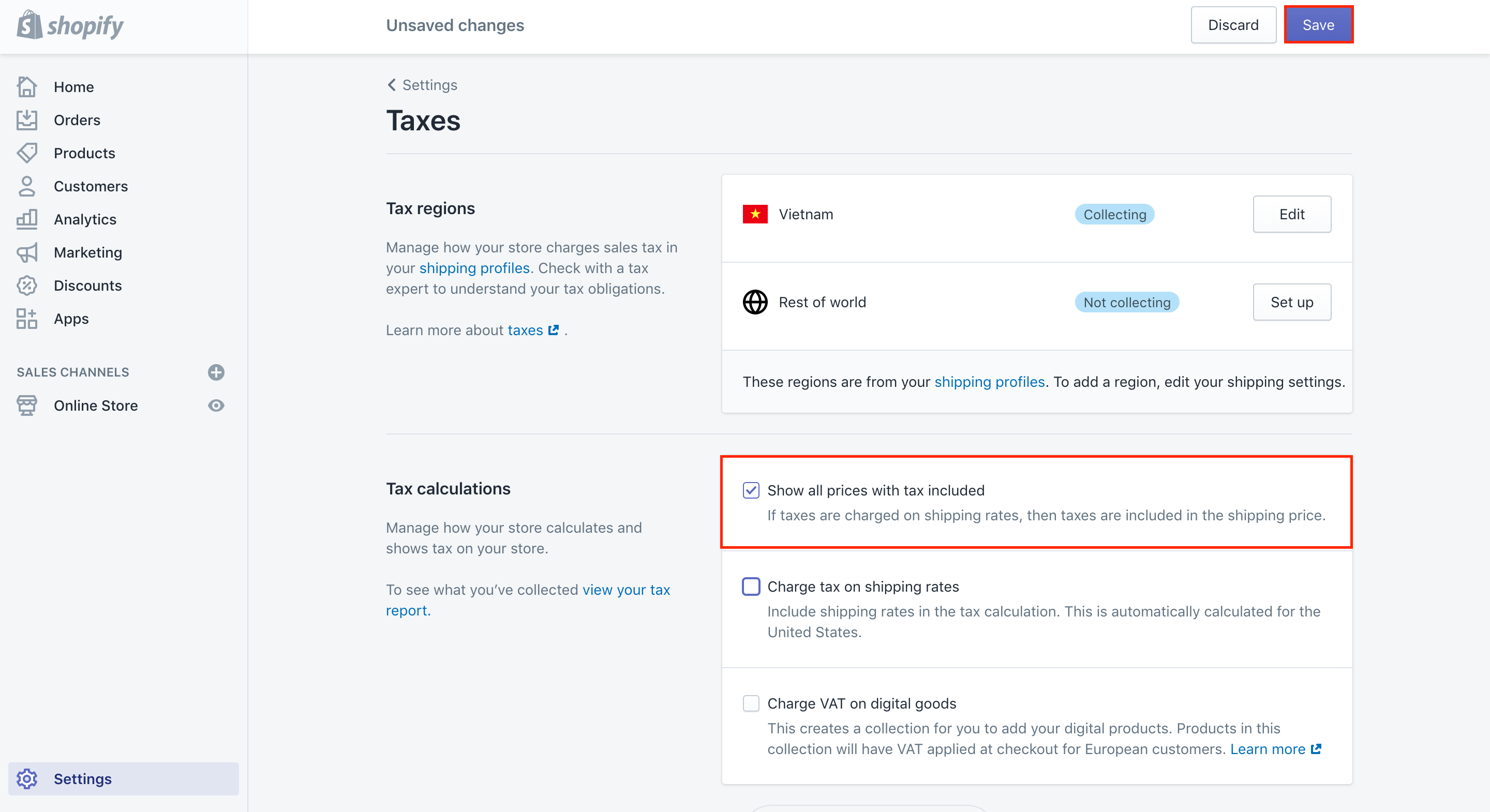

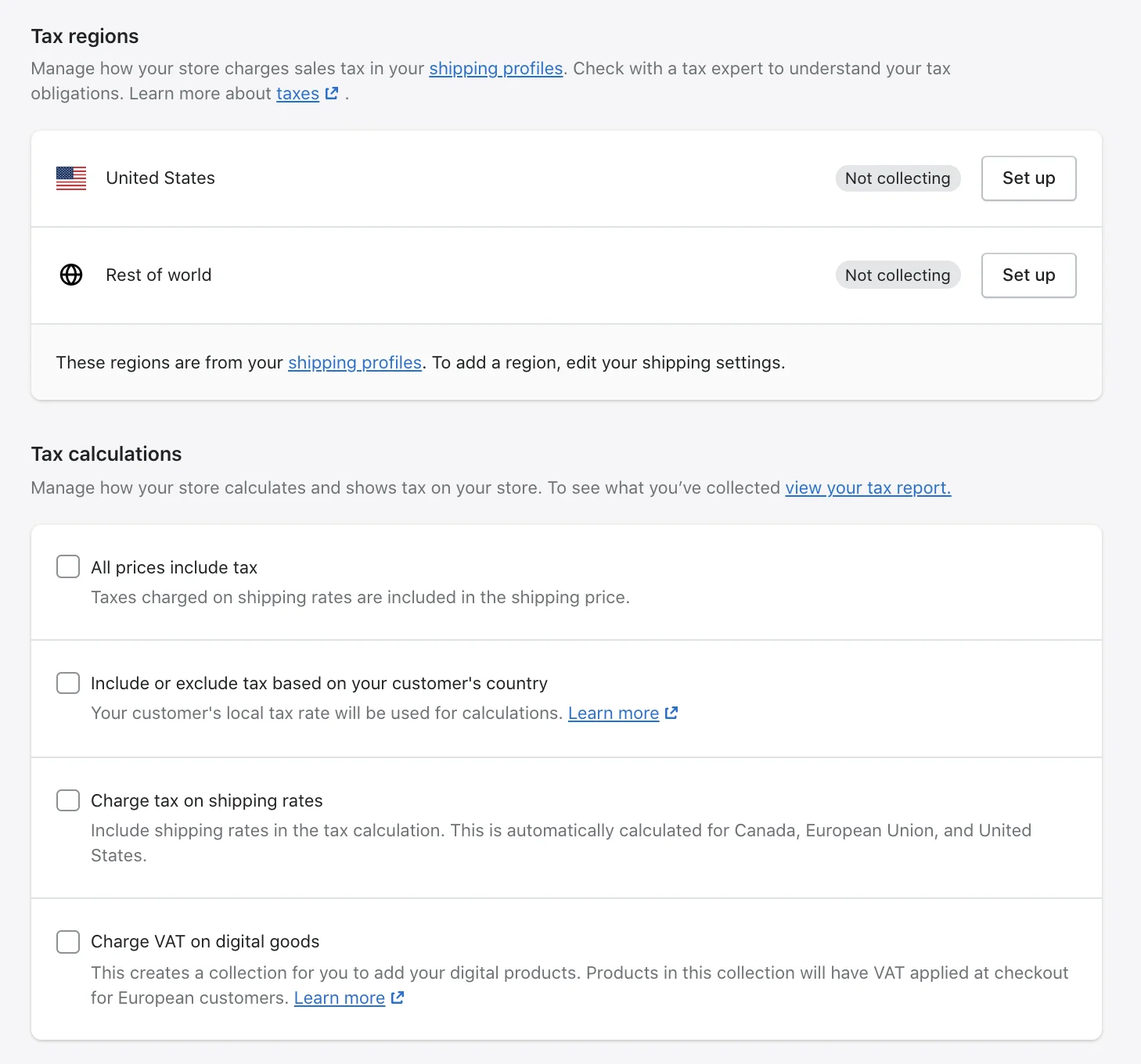

Shopify uses default sales tax rates from around the world and theyre updated regularly. A note on sales tax rates. Use Shopifys tax calculation tool.

A key feature of Shopify Markets available to Shopify Advanced and Plus merchants is a native Duties Import Taxes calculator which lets merchants calculate and. For example in the 90210 zip code the tax rate is the 65. Hello Can you please update on which base tax is calculated within accountings in a state.

So we are registered in California and if we shipped to different states in California. Shopify Basic not supported. I currently have the auto tax calculator.

Calculate and collect the total landed cost for international orders. Lets plan your success. Simply enter the applicable.

Lets plan your success. Usually the vendor collects the sales tax from the consumer as the consumer makes a. States set a rate and then localities can add a percentage on top of those rates.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The maximum an employee will pay in 2022 is 911400.

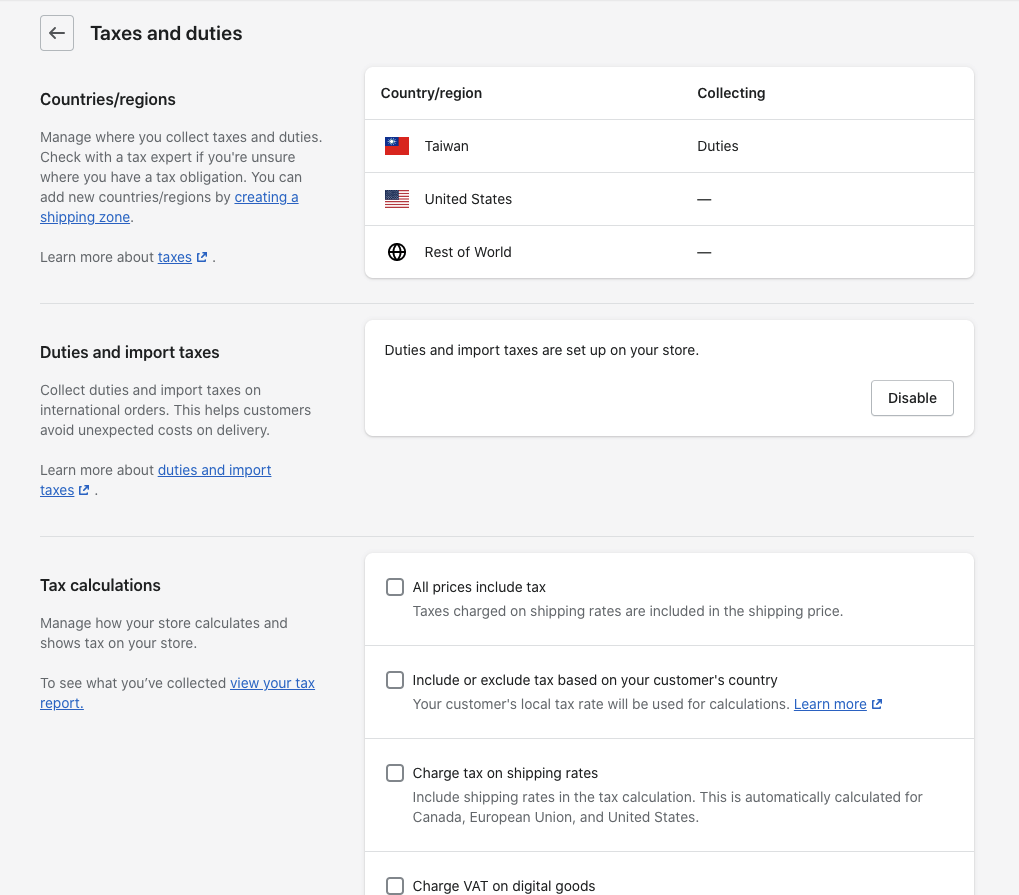

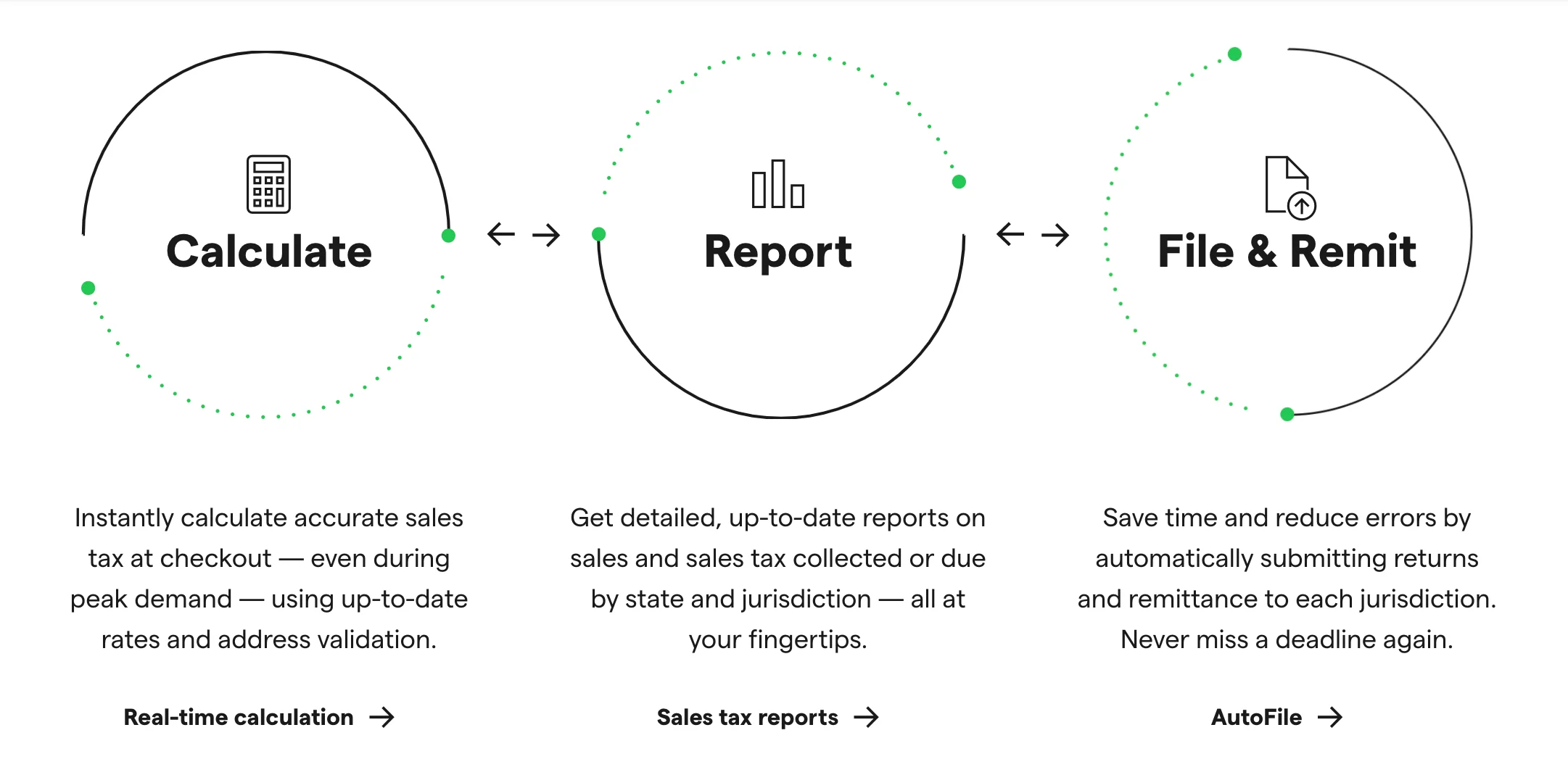

Shopify Duties And Taxes Support Shopify Markets Easyship Support

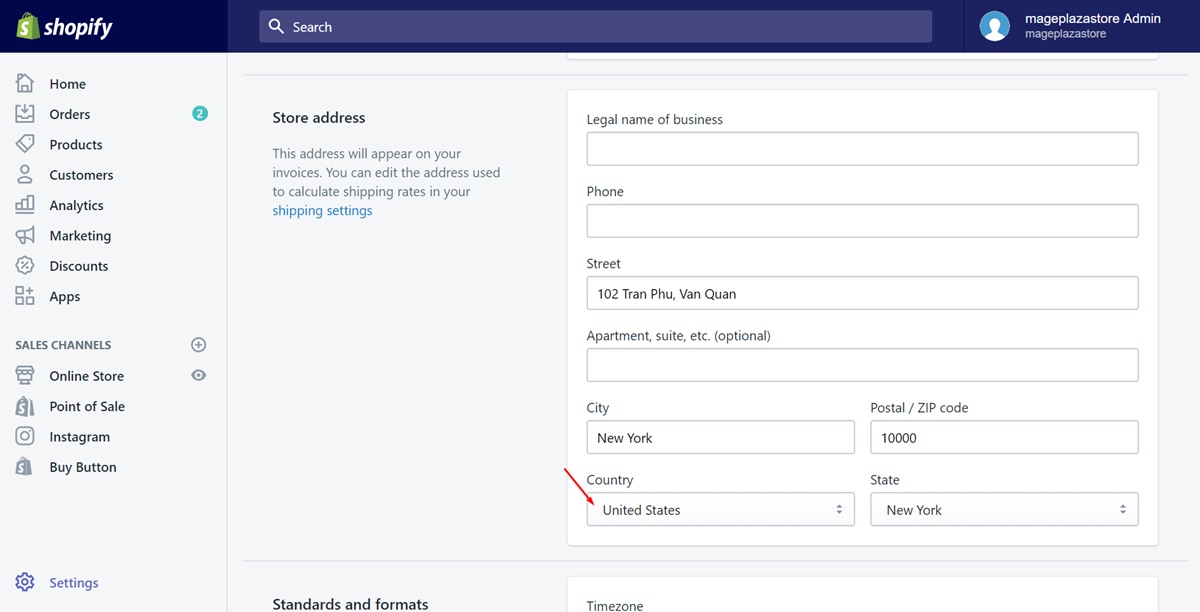

How To Charge Shopify Sales Tax On Your Store Aug 2022

How To Charge Shopify Sales Tax On Your Store Aug 2022

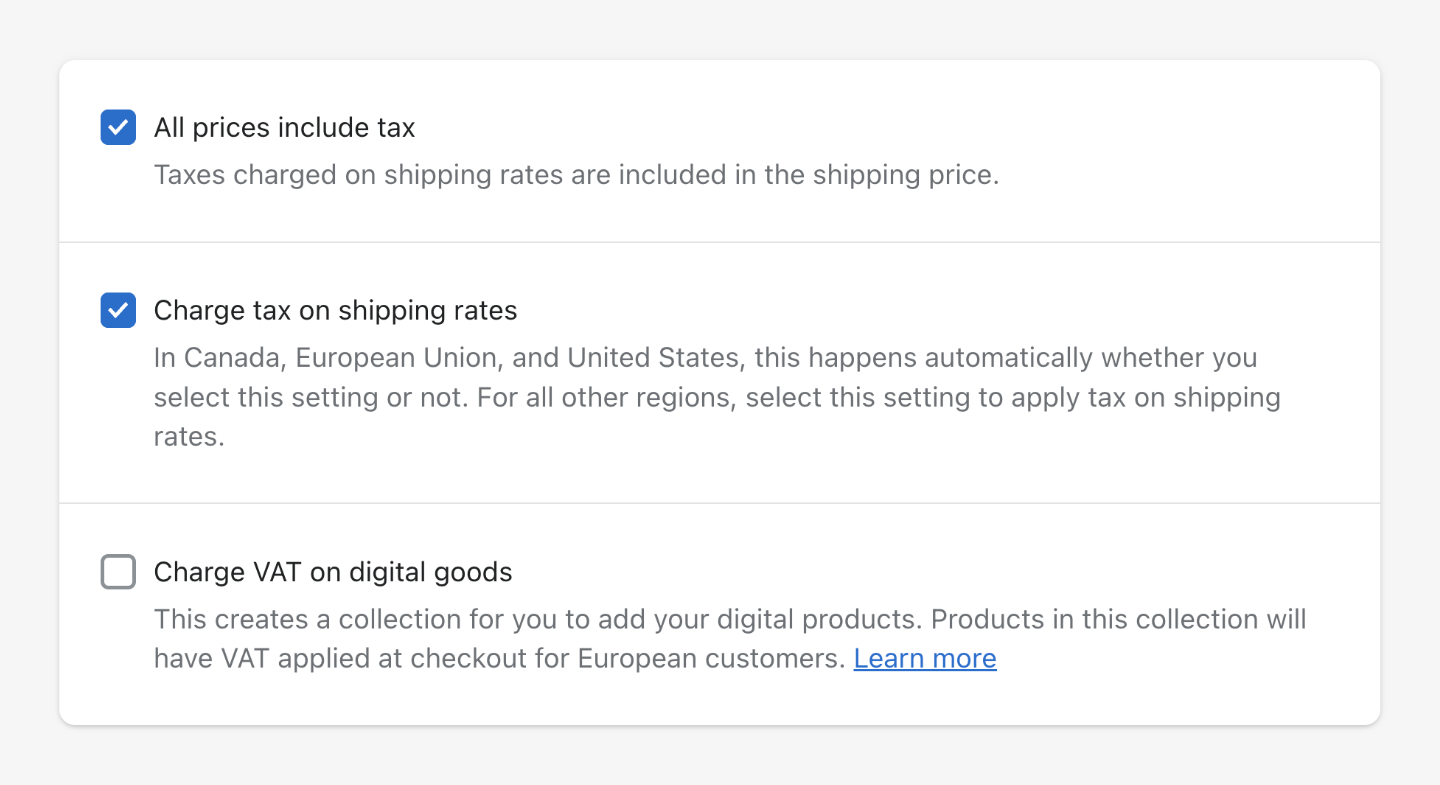

Charge Tax On Shipping Rates In Shopify Sufio For Shopify

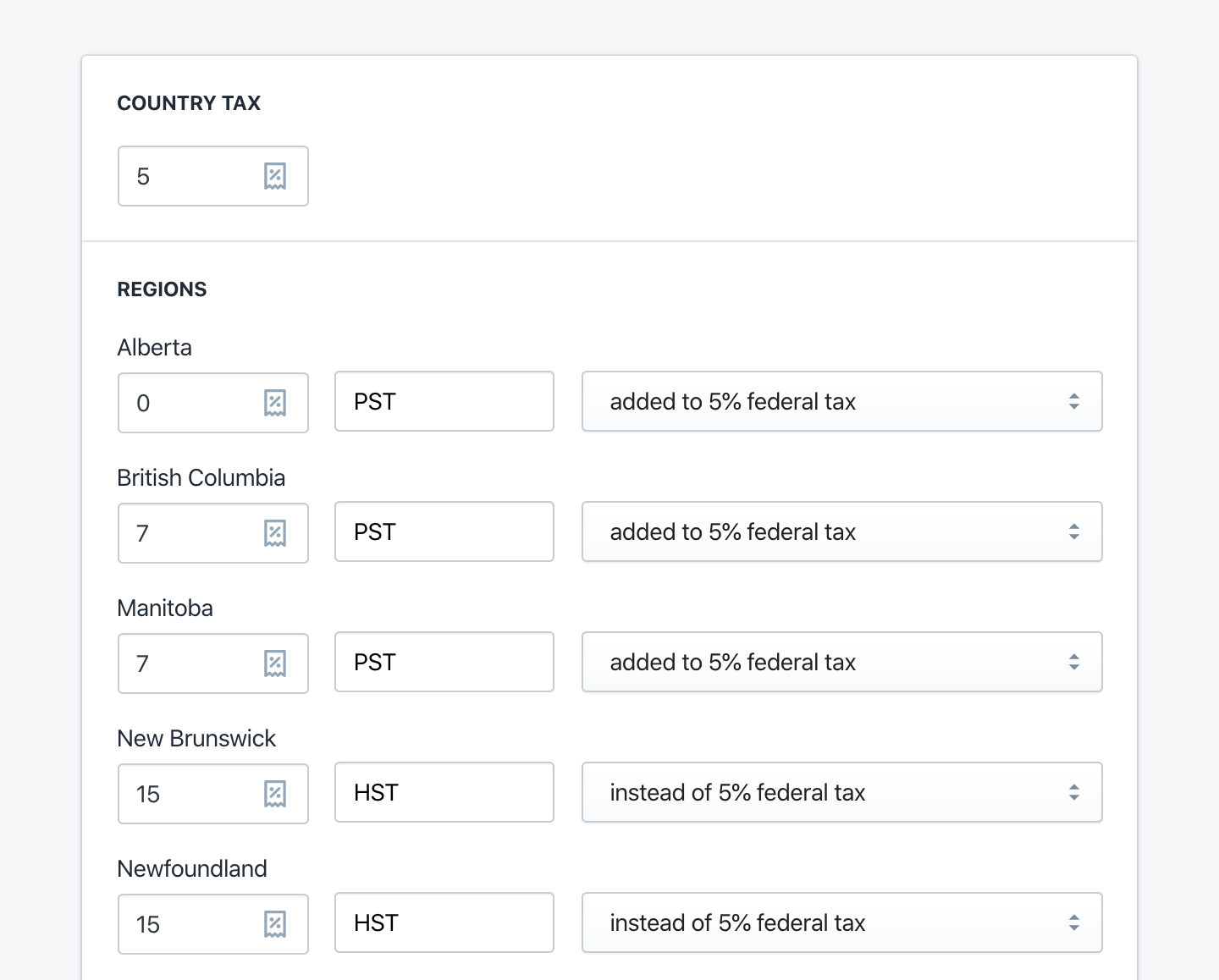

Set Up Canadian Taxes In Your Shopify Store Sufio For Shopify

How To Setup Shipping And Taxes In Shopify Youtube

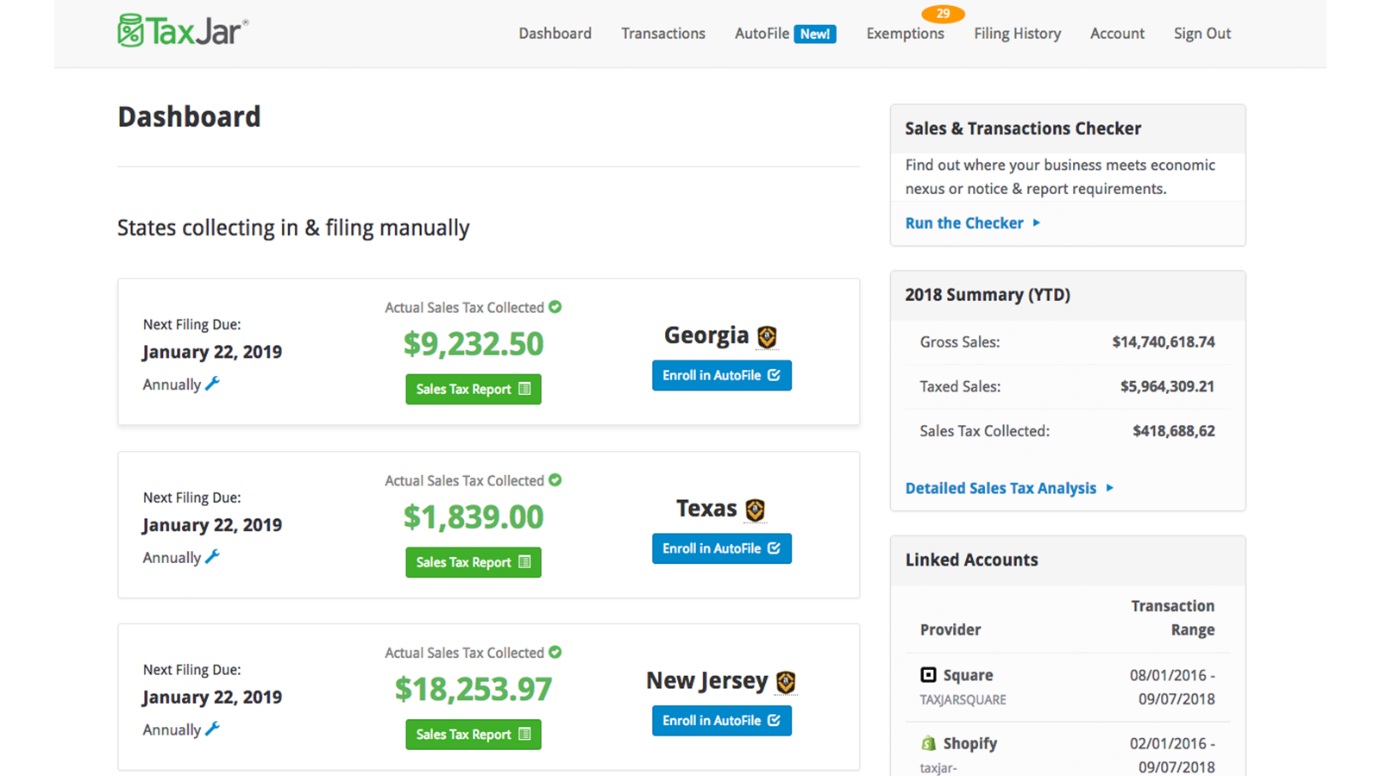

Make Sense Of Your Sales Tax Across The Us And Canada 2022

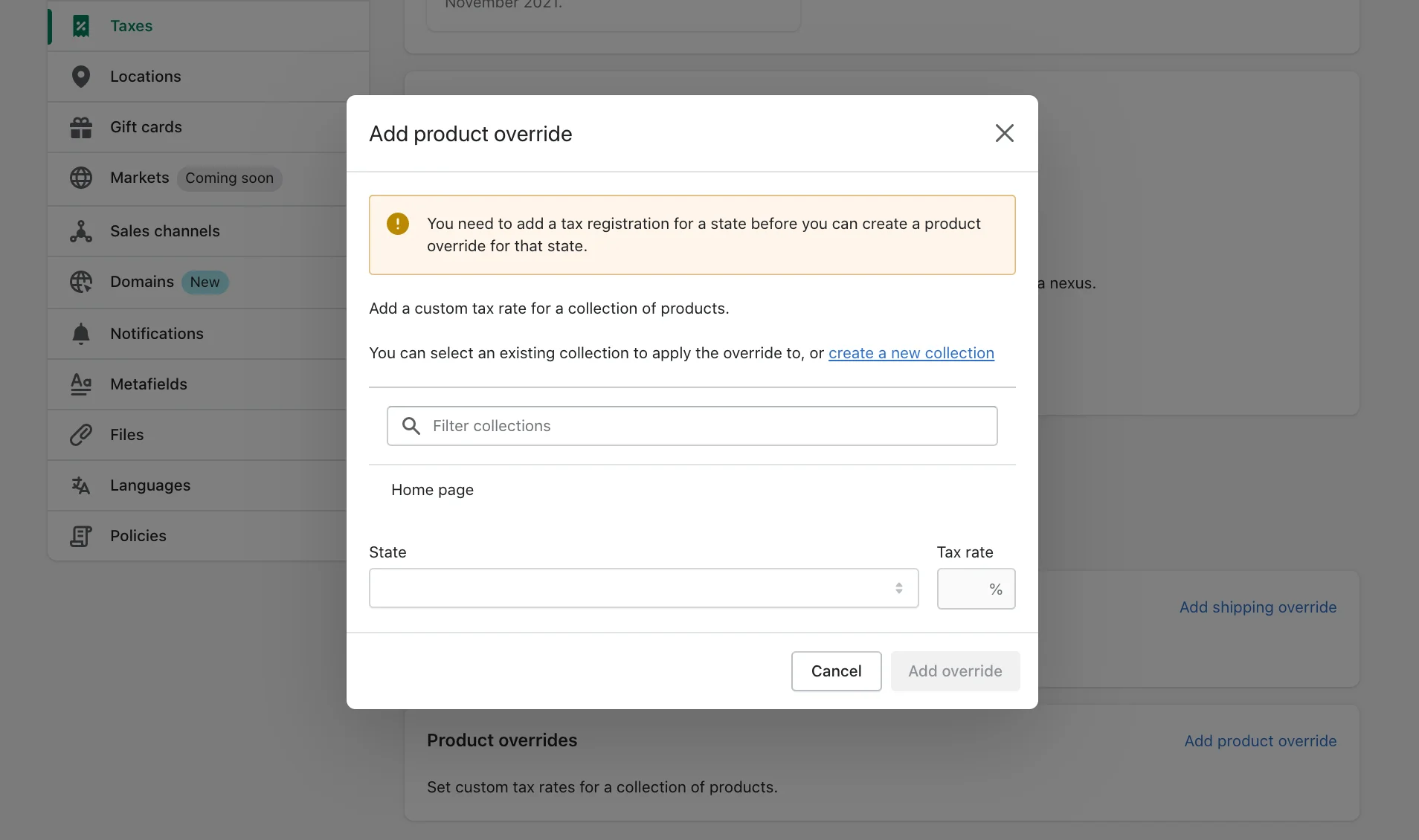

How To Charge Shopify Sales Tax On Your Store Aug 2022

How To Charge Taxes On Shopify Store

What Is The Formula For Tax Calculation On Shopify Orders Shopify Community

Benefits Of Netsuite Shopify Integration Make Business Integrity Shopify

Make Sense Of Your Sales Tax Across The Us And Canada 2022

Configuring Tax Settings With The Shopify Checkout Integration Recharge

How To Charge Shopify Sales Tax On Your Store Aug 2022

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet

How To Charge Shopify Sales Tax On Your Store Aug 2022

Top Sales Tax Apps For Shopify 2022 Acquire Convert